Part 2: Retention and Service Briefs

Boost customer retention

We’ve developed a variety of tips and best practices to help agents enhance their customer retention. These pieces include specific actions you can take today.

Do you know your customer retention rate? Are you measuring it regularly?

Your customer base is the foundation of your insurance agency and high customer retention rates are critical to your agency’s success.

After all, acquisition costs for replacing them are high. In fact, getting a new customer versus selling to an existing one is much higher in insurance than other industries, according to Daily Fintech.

To calculate your agency’s customer retention rate, first identify a consistent time frame you want to measure. This could be weekly, monthly, or quarterly.

Take your total number of customers at the end of the period (E) and subtract the new customers you acquired (N). Then, take that number and divide it by your total customer base at the start of the period (S). Finally, multiply the final number by 100.

Here’s an example of the formula in action, provided by Zendesk.

Repeat this calculation on a consistent basis to track your customer retention. The average customer retention rate within the insurance industry is 84%, according to PC360, and the most successful agencies retain around 95% of their customers.

![[(E - N)S] x 100(1) Gif [(E - N)S] x 100(1) Gif](/images/default-source/uploadedimages/(e---n)s-x-100(1)-gif.gif?sfvrsn=6f77c15c_0)

Customers across all industries are using social media to air their questions or concerns. Insurance agencies are not exceptions. From an agency perspective, handling customer service requests on platforms like Twitter and Facebook can save time and money, in addition to providing direct access to existing and potential customers.

But if you choose to do it, you must be consistent. It’s important to monitor your social channels daily to answer all questions in a timely manner, demonstrating your commitment to responsive customer service. And you should take screenshots of everything and add it to your agency management system to ensure you always have a record.

The public nature of social media is two-sided. It enables prospects and other customers to see your responsiveness. But it also means any missteps can put your reputation at stake. Before engaging with customers online, you should craft organization-wide guidelines for replying to concerns quickly and in a manner that aligns with your agency’s values. These guidelines should cover who has permissions to respond on each platform, messaging tone, response time, answers to frequently asked questions, and escalation protocols, according to Hootsuite.

Sometimes, customer service requests will require the exchange of confidential information. When it comes to insurance, that should always be a private discussion. It’s important to move the discussion to private channel mode. For example, Facebook allows users to respond privately to public comments in Facebook Messenger. A note will then automatically appear under the public comment reading, “Page responded privately,” letting others know you resolved the issue. If you respond to a Twitter post using its direct messaging service, you can leave a public reply under the original Tweet asking the customer to check their DMs.

According to Birdeye if someone posts a complaint about your agency, you should respond within 48 hours by offering an apology and suggesting the conversation move to a DM, email, or phone call. Avoid sending an automated reply, but to streamline the process, create a template in which you can fill in personalized information. This includes the customer’s name and how the issue will be resolved. Also, the negative review shouldn’t be deleted.

With so many different avenues of communication, it’s important to stay on top of your customer support.

Every agency can develop a culture focused on customer retention—it takes communication and practice. Consider these ideas:

- Emphasize the importance of routine, proactive communication

with clients and personalized interactions with your team. - Highlight client interactions in team meetings.

Have the staff involved talk about what they did. - Set up a schedule with checkpoints throughout the year

to touch base with clients, including policy renewals,

birthdays, and holidays. - Make client conversations meaningful by individualizing them.

- Provide a safety goody bag to clients who visit the office.

- Ask clients how they want to receive information: email, text, mail,

phone calls, or all of the above. - Never overcommit to things you can’t deliver.

- 1. Perfect your client onboarding process. A positive first impression matters—after all it reinforces the decision to work with your agency.

- 2. Keep the 2-way client communication flowing. Make sure you provide customers with clear information about how and when to contact you and give them plenty of outbound information too.

- 3. Treat your customers like individuals and tailor your messaging to their needs. Ask them how they want to receive information, and make sure to follow what they say.

- 4. No surprises—always alert customers to bad news coming—like increasing premiums—and work to give them options. It pays to be proactive and transparent.

- 5. Give clients more reasons to work with you. Cross-sell policies. The more they buy and work with your agency, the more opportunity for you to shine.

- 6. Use technology solutions that automate mundane and technical tasks like the policy and claims process.

- 7. Stay active on social media. Facebook and Twitter can be important marketing tools and provide a direct line of communication to clients.

- 8. Survey your client base. They can help you identify areas of weakness and gauge satisfaction.

It’s a win-win. Referrals from our agency’s existing customer base can generate new leads. Not only is this cost effective, but customers can get satisfaction for sharing information.

Connections made through referrals are built on trust and understanding. Referrals can also deepen the existing connection between you and the recommenders.

Agents shouldn’t be afraid to ask satisfied clients to post a review of their experience. Online reviews are also powerful tools to enhance your visibility and credibility. This process can be automated with technology solutions that request reviews after client interactions or at specific milestones.

Online reviews will come from a variety of different digital platforms, including Google, Facebook, and Better Business Bureau. Agents should frequently check review sites, interact with positive reviewers, and address potential negative reviews. Respond to bad reviews as quickly as possible while remaining professional and calm. If there is an option to respond directly, address concerns respectfully.

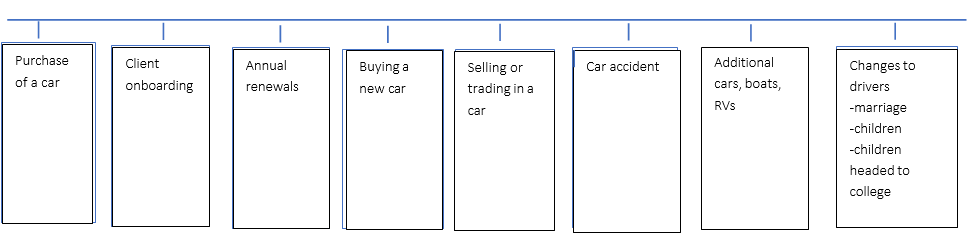

When car owners are retained, they can be good customers over the long-term. Americans own an average of 1.88 cars, according to the US Department of Transportation. They typically own those cars between six and eight years, and more than likely, when they sell or trade in a car, they’re replacing it with another. Add to that the addition of other insurable vehicles (boats, RVs, other cars) and other drivers (children), focusing on retaining auto insurance clients is important.

For insurance agencies, it’s critical to know when to communicate with those customers. Consider these checkpoints in the lifecycle.

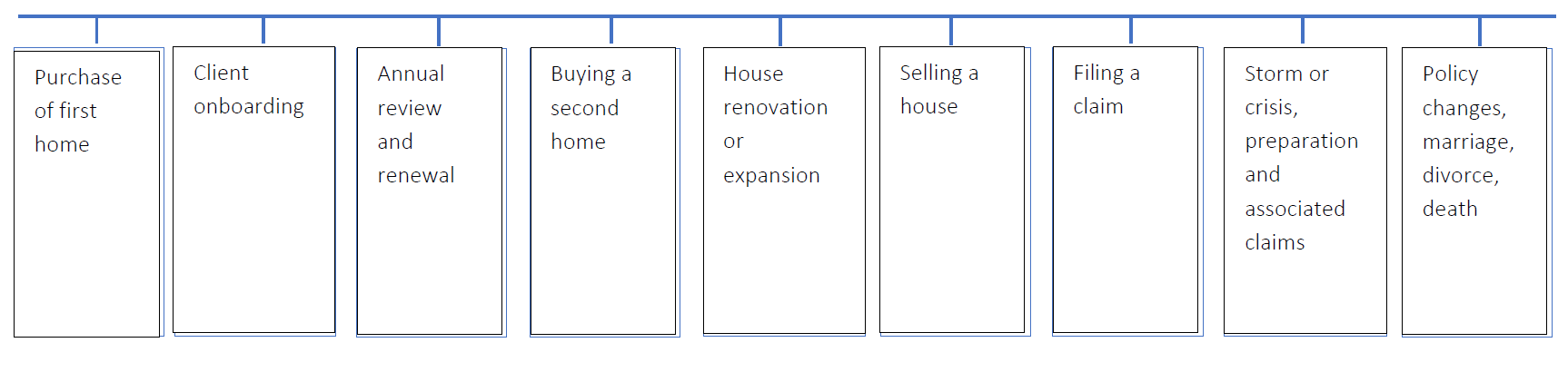

When clients buy their first homes, it’s a big deal for them. And it’s a big deal for the agency because it can create a customer for life. The sale typically occurs before the homeowner can close.

Turning that first-time buyer into a repeat customer is key. Agents know that building strong relationships with homeowners can take years. It’s critical to know when to communicate with these clients. Consider these checkpoints in the lifecycle.

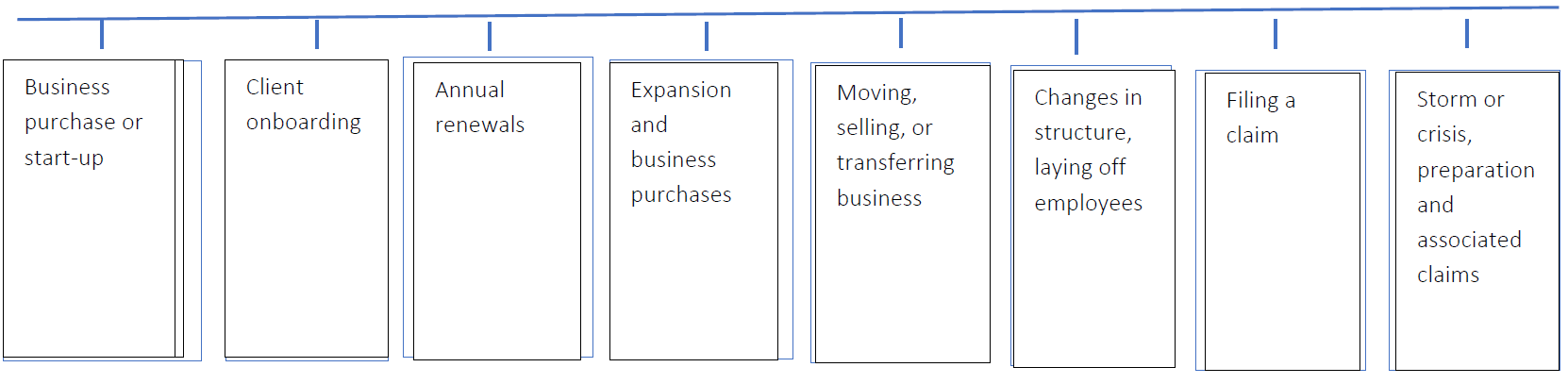

There are more than 33 million small business in the US today. A large number are under-insured or not insured at all—representing a huge opportunity for agencies that sell small commercial. Turning that prospect into a first-time buyer and working with them to provide add-ons such as cyber or liability may take place over months or years, as agents build trust with their clients. And most importantly, agencies want to make sure that they retain these businesses they’ve invested in.

Consider these checkpoints in the lifecycle.